🔹 Introduction

If

you are running a business in India, filing GSTR‑1

is one of the most important GST compliances you cannot ignore. Whether you are

a small trader, manufacturer, or SME, GSTR‑1 ensures

your sales data is correctly reported to the GST system. Errors or delays can

lead to penalties, notices, or blocked Input Tax Credit (ITC) for your

buyers.

In

this guide, we’ll cover: -

·

What

is GSTR‑1

·

who

should file it

·

Due

dates (monthly & quarterly)

·

Step‑by‑step process

to file GSTR‑1

online

·

Common

mistakes to avoid

·

Penalties

for late filing

·

FAQs

for easy understanding

(References:

Section 37 of CGST Act, 2017 & Rule 59 of CGST Rules, 2017)

🔹 What is GSTR‑1?

GSTR‑1

is a monthly/quarterly return that contains details of all outward

supplies (sales) made by a registered taxpayer.

·

It

includes B2B, B2C, exports, and exempt supplies etc.

· Once

you file GSTR‑1,

the details flow automatically to the buyer’s

GSTR‑2B,

enabling ITC.

👉

Simply put, GSTR‑1

= Your sales report to GST Department.

Legal

Reference: Section 37(1) of CGST Act –

Every registered person (except composition taxpayers, ISD, TDS/TCS deductors)

shall furnish details of outward supplies in GSTR-1.

🔹 Who Should File GSTR‑1?

·

All

regular taxpayers registered under GST.

·

Casual

taxable persons.

·

SEZ

units and developers.

·

Exporters.

❌ Exempted:

Composition scheme taxpayers (they file CMP‑08

instead).

🔹 GSTR‑1

Due Dates in 2025

|

Filing Type |

Turnover |

Frequency |

Due Date |

|

Monthly GSTR‑1 |

> ₹5

crore |

Monthly |

11th of next month |

|

Quarterly GSTR‑1

(QRMP) |

≤ ₹5

crore |

Quarterly |

13th of month following quarter |

⚠️

Missing the due date results in late fee + interest (Sec. 47).

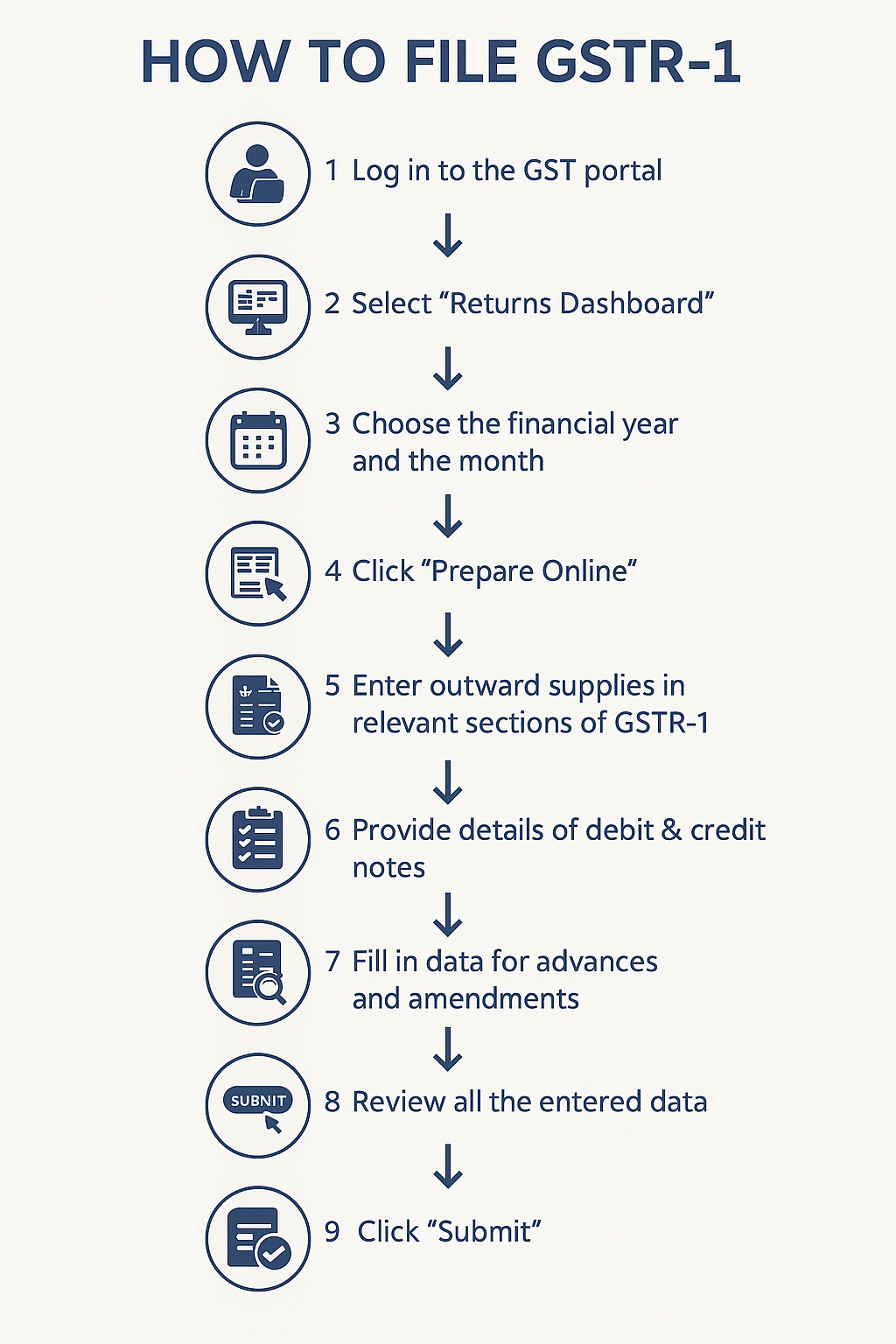

🔹

Step‑by‑Step Process to File

GSTR‑1 Online

Step

1: Login to GST Portal.

Step 2: Go to Returns Dashboard → Select period.

Step 3: Click Prepare Online under GSTR‑1.

Step 4: Enter details:

·

B2B

Invoices (GSTIN of buyers, taxable value, tax rate)

·

B2C

Large (value > ₹2.5 lakh interstate)

·

B2C

Small (consolidated)

·

Exports

(with/without payment of tax)

·

Credit/Debit

Notes

Step 5: Save, Preview & Submit.

Step 6: File using DSC/EVC.

Step 7: ARN generated → Acknowledgement of filing.

🔹

Common Mistakes in GSTR‑1 Filing

·

Wrong

GSTIN entry for buyers → Buyer loses ITC.

·

Mismatch

between GSTR‑1 vs GSTR‑3B.

·

Missing

export invoices.

·

Not

reporting credit/debit notes.

·

Filing

late → attracts penalties.

🔹

Penalties for Late Filing (Sec. 47)

·

Late

Fee: ₹50 per day (₹25 CGST + ₹25 SGST).

·

Nil

Return Late Fee: ₹20 per day (₹10 CGST + ₹10 SGST).

·

Max

Cap: ₹5,000 per return.

·

Interest: 18% p.a. on tax liability (if

any).

👉 Delay also blocks your buyer’s

ITC claim → impacts business relations.

🔹 FAQs on GSTR‑1

Q1. Can I

revise GSTR‑1?

No direct revision option. Corrections can be made in the next return or

amended GSTR-1 can be filed.

Q2. What if I don’t file GSTR‑1?

You cannot file GSTR‑3B

until GSTR‑1

is filed. Notices may be issued.

Q3. Can I file NIL GSTR‑1?

Yes, if no outward supplies in a period → file NIL GSTR‑1.

Q4. What is IFF in QRMP scheme?

Invoice Furnishing Facility (IFF) lets quarterly filers upload monthly B2B

invoices.

🔹 Conclusion

Filing GSTR‑1 accurately and on time is crucial for compliance,

avoiding penalties, and ensuring your buyers can claim ITC smoothly. With the

right process and checklist, SMEs and traders can file hassle‑free.

📌 Need help with GSTR‑1 filing or facing GST notice issues?

Contact TechTax – Your Trusted GST Partner in Ghaziabad, Noida & Delhi.