🔹 Introduction

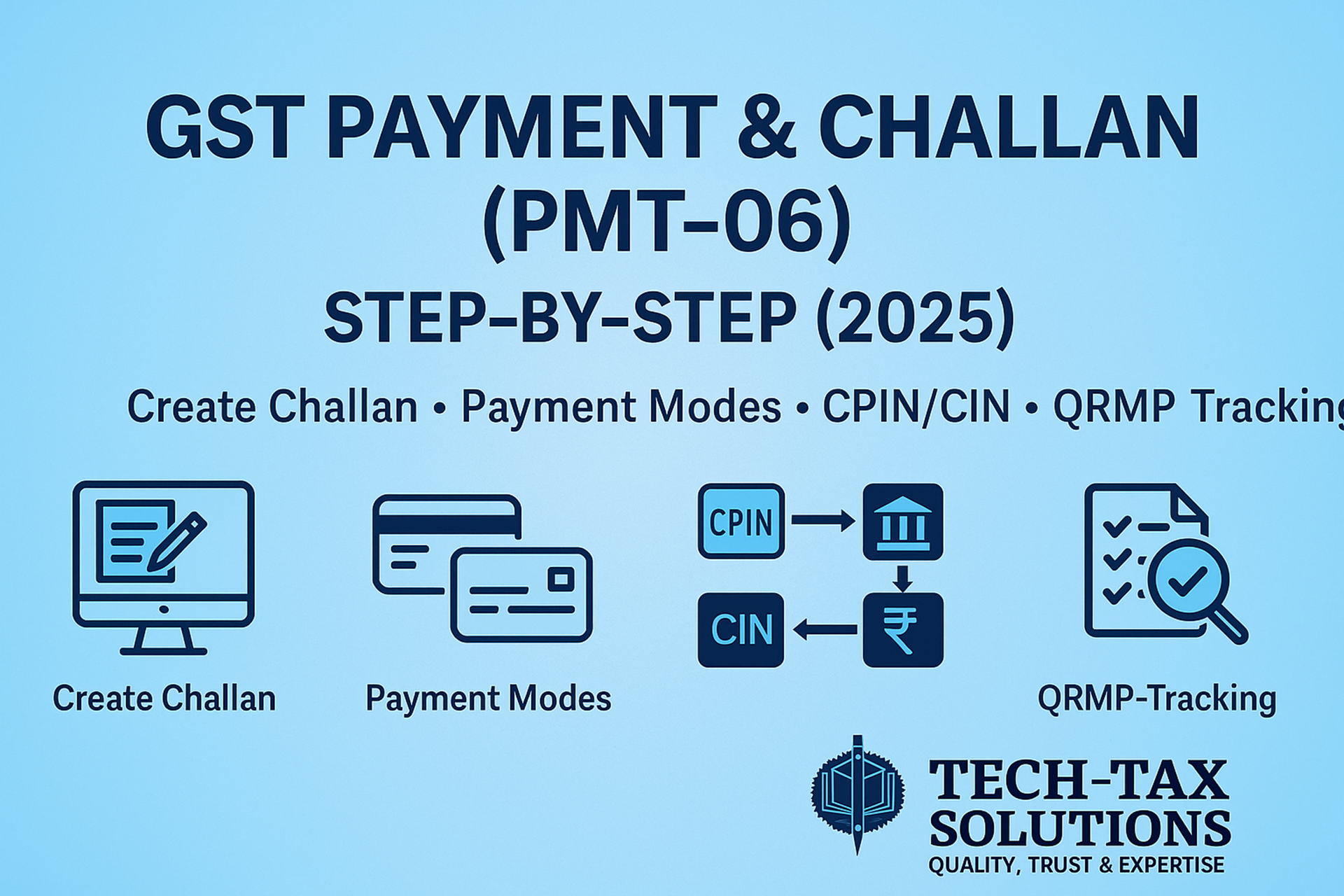

GST payment is one of the most crucial compliances for businesses. Whether you are a monthly filer or under the QRMP scheme, tax must be paid through Form GST PMT-06. It is used to deposit tax, interest, penalty, fee, or any other amount into the Electronic Cash Ledger, which is then used to discharge liabilities.

This article provides a step-by-step guide to creating and paying GST challans in 2025.

(References: Sec. 49 of CGST Act, Rule 87 of CGST Rules, CBIC FAQs and notifications till 2025)

🔹 Who Needs to Pay Using PMT-06?

-

All registered taxpayers who need to deposit tax/interest/penalty/fees.

-

QRMP taxpayers (turnover ≤ ₹5 crore) must pay monthly tax using PMT-06 for the first 2 months of the quarter.

-

Even NIL liability taxpayers may generate challan if needed for interest/penalty.

🔹 Due Dates

-

Monthly taxpayers: 20th of following month (while filing GSTR-3B).

-

QRMP taxpayers: 25th of month following 1st and 2nd month of quarter.

-

Challan validity: 15 days from generation.

🔹 Step-by-Step Process to Generate & Pay GST Challan

📌 Step 1: Login to GST Portal

Visit gst.gov.in → Services → Payments → Create Challan.

📌 Step 2: Select Reason for Challan

Choose: Monthly Return, Quarterly Payment (QRMP), or Any Other Payment. Enter tax period.

📌 Step 3: Enter Tax Amounts

Fill liability under IGST, CGST, SGST/UTGST, Cess, Interest, Penalty, or Fee.

📌 Step 4: Choose Payment Mode

-

Net banking / Credit-Debit card / UPI.

-

NEFT/RTGS (mandate form generated).

-

Over-the-counter (cash/cheque/DD, subject to limits).

📌 Step 5: Generate Challan

A CPIN (Challan Portal Identification Number) is generated. This is valid for 15 days.

📌 Step 6: Make Payment

-

If online: Redirects to bank gateway. On success, a CIN (Challan Identification Number) is generated, and amount reflects in Electronic Cash Ledger.

-

If NEFT/RTGS: Submit mandate form to bank. Ensure payment within validity.

📌 Step 7: Track Payment Status

Go to Services → Payments → Track Status. Use CPIN or CIN.

📌 Step 8: Ledger Update

Once CIN is confirmed, balance shows in Electronic Cash Ledger. This balance can then be used to discharge liabilities while filing GSTR-3B or other returns.

📌 Step 9: In Case of Errors

-

If bank debited amount but CIN not generated, file grievance in Form PMT-07.

-

If paid under wrong head, approach jurisdictional officer for remedy.

🔹 QRMP Scheme – PMT-06 Payments

-

Taxpayers under QRMP must deposit tax by 25th of next month (for 1st & 2nd month of quarter).

-

Two methods:

-

Fixed Sum Method (35% challan): System-generated challan based on last return.

-

Self-Assessment Method: Calculate actual liability and pay through PMT-06.

-

🔹 Common Mistakes & Fixes

-

⚠️ Not paying within 15 days → CPIN expires. ✅ Regenerate challan.

-

⚠️ Using wrong tax head. ✅ Double-check before submission.

-

⚠️ Ignoring CIN confirmation. ✅ Always track and download receipt.

-

⚠️ Missing QRMP due date (25th). ✅ Mark calendar reminders.

🔹 Interest & Late Fee

-

Interest: 18% per annum under Sec. 50 for delayed tax payment.

-

Late fee: Separate for late return filing under Sec. 47 (₹50/day, ₹20/day for NIL returns).

-

Non-payment may lead to notices under Sec. 74A.

🔹 Practical Examples

-

Monthly filer: A trader owes ₹25,000 CGST+SGST. Creates PMT-06 challan, pays online via net banking, CIN generated instantly.

-

QRMP filer: A manufacturer in Noida under FSM sees pre-filled challan of ₹18,000, pays via NEFT by 25th. Ledger updated for use while filing quarterly GSTR-3B.

🔹 Best Practices

-

✅ Always generate challan on portal, never pay directly to bank without CPIN.

-

✅ Pay early, don’t wait till last day.

-

✅ Keep CPIN & CIN receipts.

-

✅ For QRMP, decide FSM vs SAM in advance.

-

✅ Reconcile cash ledger regularly.

🔹 FAQs

Q1. Can challan be revised after generation?

➡️ No, generate a new challan if corrections needed.

Q2. Can I pay via UPI?

➡️ Yes, UPI and IMPS are available for e-payment.

Q3. What if bank debits but ledger not updated?

➡️ File Form PMT-07.

Q4. Is PMT-06 required if I have sufficient ITC?

➡️ No, cash payment only if ITC insufficient.

Q5. Can challan be paid without login?

➡️ Yes, pre-login challan creation is possible.

🔹 Conclusion

PMT-06 is the backbone of GST payments. Timely payment, correct head selection, and reconciliation ensure smooth compliance. Mistakes like expired CPINs, wrong heads, or ignoring CIN updates can cause big issues.

📌 Need assistance with GST payments, QRMP compliance, or reconciliations?

Contact Tech-Tax Solutions – Quality, Trust & Expertise in Ghaziabad, Noida & Delhi.